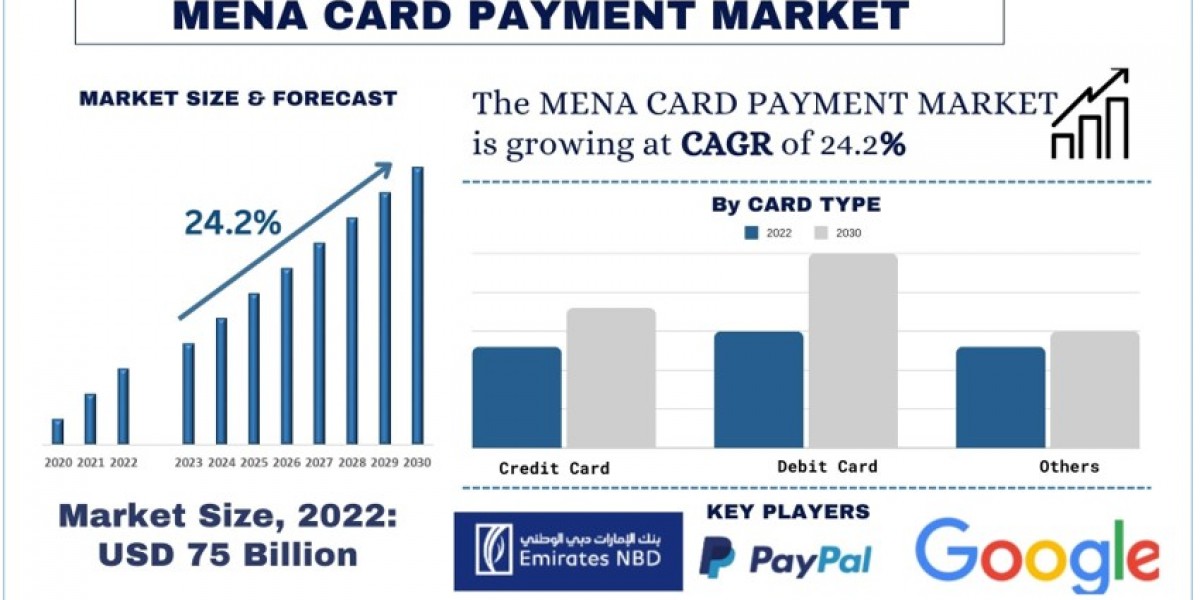

The MENA Card Payment Market was valued at USD 75,132.17 million in the year 2022 and is expected to grow at a strong CAGR of around 24.2% during the forecast period. The MENA region is experiencing a transformative shift in its payment landscape, with card payments emerging as a dominant force in facilitating transactions across various sectors.

Card Payment Demand in MENA:

The MENA region has witnessed a significant surge in the demand for card payments, driven by factors such as urbanization, digitization, and changing consumer preferences. As economies diversify and embrace technology, consumers are increasingly opting for the convenience and security offered by card transactions over traditional cash payments. This shift is particularly evident in the retail, hospitality, and e-commerce sectors, where card usage is becoming ubiquitous.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=56809

Applications:

Card payments in the MENA region are not limited to traditional credit and debit cards but also include prepaid cards, contactless payments, and mobile wallets. These innovative payment solutions cater to the diverse needs of consumers and businesses, offering flexibility, speed, and enhanced security. Moreover, advancements in fintech are driving the adoption of digital wallets and alternative payment methods, further revolutionizing the way transactions are conducted in the region.

Related Reports-

Financial Services Application Software Market: Current Scenario and Forecast (2019-2025)

Micro Lending Market: Current Analysis and Forecast (2022-2028)

Government Initiatives:

Governments across the MENA region is actively promoting the adoption of electronic payments to drive financial inclusion, reduce cash dependency, and stimulate economic growth. Initiatives such as regulatory reforms, infrastructure development, and awareness campaigns are being implemented to create an enabling environment for card payment acceptance. Additionally, collaborations between governments, financial institutions, and technology providers are facilitating the integration of digital payment solutions into everyday transactions.

Recent Developments/Awareness Programs: - Several key players and governments are rapidly adopting strategic alliances, such as partnerships, or awareness programs for the treatment: -

· In Jan 2024, The Qatar Investment Authority (QIA) established a 200 million USD fund in partnership with the Ashmore Group. The fund, known as the Ashmore Qatar Equity Fund, aims to provide foreign and local investors with exposure to Qatar's fast-developing economy and access to Ashmore's investment expertise.

· As of 2023, more than 83% of Kuwaitis are willing to adopt Card Payment solutions.

· In January 2023, Emirates NBD Securities, a leading brokerage firm in the UAE, partnered with the Abu Dhabi Securities Exchange (ADX) to provide traders with instant access to the exchange's listed companies, enabling it to offer instant trading account opening and digital onboarding to another UAE stock exchange.

Conclusion:-

In conclusion, the MENA card payment market is undergoing a remarkable transformation, fueled by technological innovation, changing consumer behavior, and supportive government policies. As card payments continue to gain momentum across various sectors, the region is poised for further growth and expansion in the digital payments ecosystem. With ongoing advancements in technology and increasing collaboration among stakeholders, the future of card payments in the MENA region looks promising, offering immense opportunities for financial inclusion, economic development, and enhanced convenience for consumers and businesses alike.