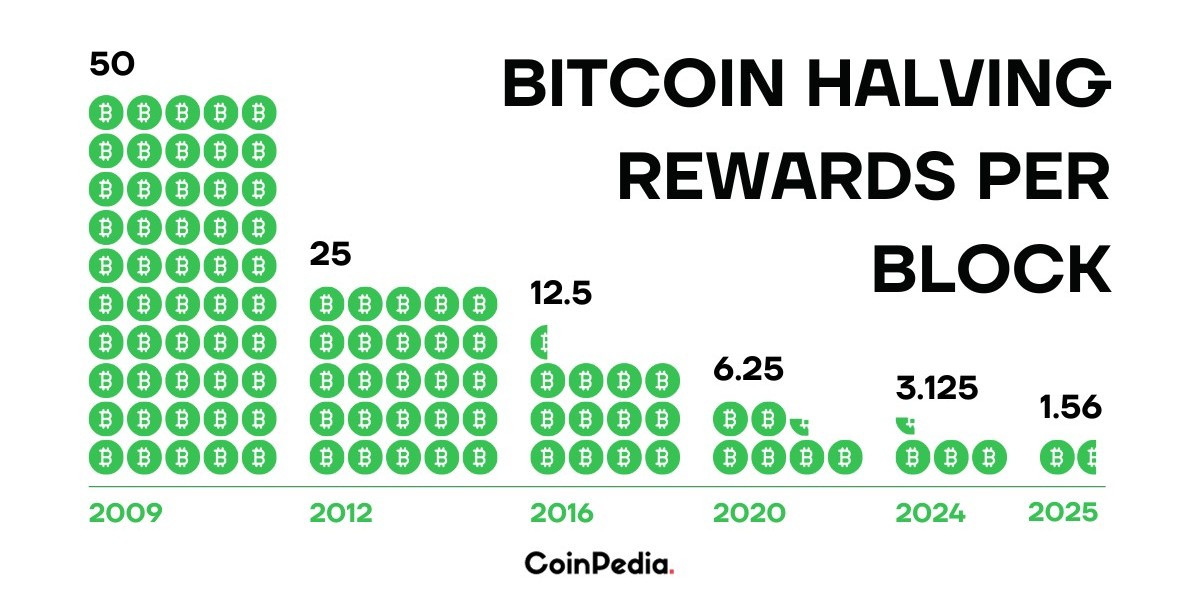

Discover how the upcoming Bitcoin halving in 2024, scheduled for April 19th, will impact the cryptocurrency market. Learn how this event, reducing the block reward to 3.125 BTC, historically affects Bitcoin's price dynamics. Explore insights and predictions for Bitcoin halving 2024

The upcoming

Bitcoin Halving 2024 is scheduled for April 19, 2024, and is expected to reduce the block reward to 3.125 BTC. This move is significant because it will affect the amount of new bitcoin produced. In the past, such events have often led to a decline in the supply of new currency and an increase in the price of bitcoin.

Looking back at the historical data, we see that the first half of 2012 saw the block reward drop to 25 BTC, with a surprising increase in value. The second half of 2016, with the prize at 12.5 BTC, saw the same. The most recent installment for 2020 reduced the reward to 6.25 BTC, matching Bitcoin’s peak price at $67,549.

So, how does the Bitcoin part work? Essentially, this happens about every four years, causing the number of new bitcoins to dwindle. This fixed scarcity policy aims to limit supply, which in turn can reduce inflation and increase the value of bitcoin.

Market forecasts for the coming half suggest that this could increase demand and potentially push up prices as supply contracts. However, it is important to note that although historical data shows that prices rise after infusions, other market factors at play could affect bitcoin prices.

In summary, the bitcoin segment is an important piece of information that shapes market dynamics by imposing higher prices and higher scarcity. This typically leads to smooth price movements driven by changes in supply and demand within the Bitcoin ecosystem. Investors should consider these factors when assessing how the upcoming phase may affect Bitcoin’s price dynamics.

Collage★彡 Call girls in Knowledge Park 2 Noida 【8448380779】 Noida Escorts

От Maya Khan

Collage★彡 Call girls in Knowledge Park 2 Noida 【8448380779】 Noida Escorts

От Maya Khan How to Meet Dubai Escorts Online

От Terry Loman

How to Meet Dubai Escorts Online

От Terry Loman Exploring the Enigmatic World of Intimacy and Connections

Exploring the Enigmatic World of Intimacy and Connections

How to Buy Storage Containers for Digital Media

От wasay4840

How to Buy Storage Containers for Digital Media

От wasay4840 Split Testing Tools Market Status and Outlook 2023-2031

От geet0707

Split Testing Tools Market Status and Outlook 2023-2031

От geet0707